Services to Families

The "Family Meeting"

AssessmentWhere is your family today?

EducationWhy do families fail and succeed?

CommunicationHow does your family manage difficult conversations?

ValuesDoes everyone have an entrepreneurial, philanthropic, family first, grateful, mindset?

Action

How do you apply your values and make decisions as a family?

AdvancementHow will you maintain and apply what you have learned and continue to learn?

Sustaining the family by preparing the family for the assets

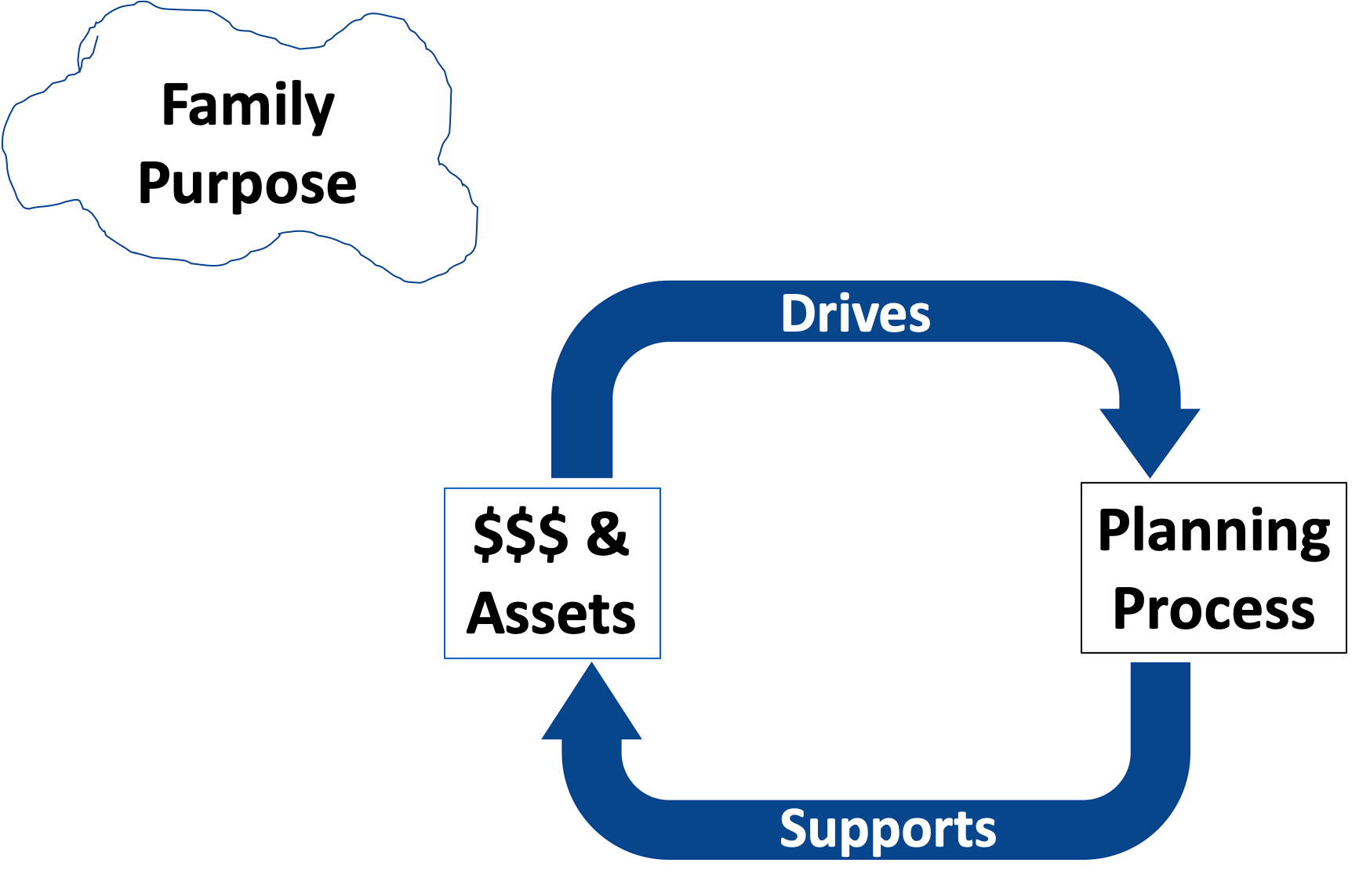

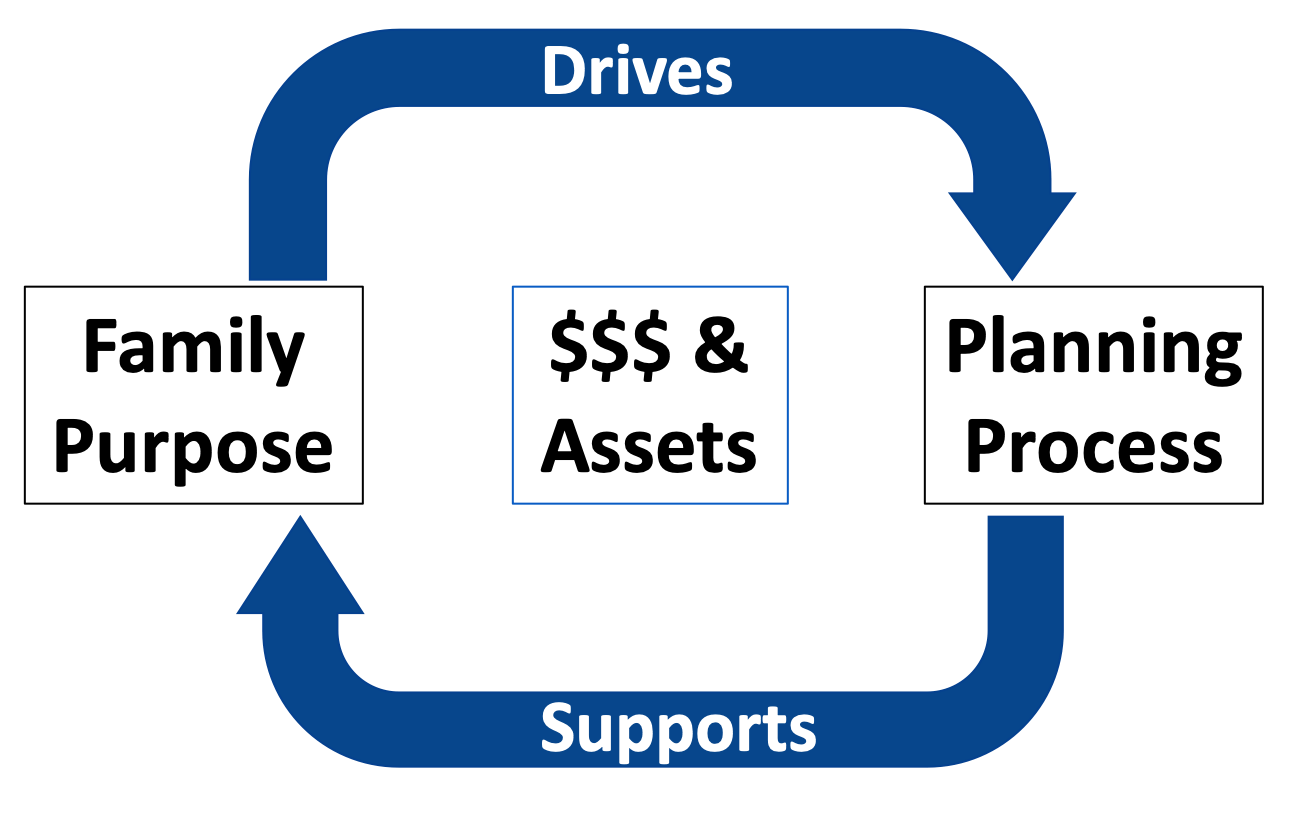

To prepare future generations for the assets and planning structures, Family Purpose

needs to drive the planning process, and the planning process needs to support the Family Purpose.

What the People Say

91%

of all wealth transfers fail before getting past the grandchildren.

61%

of wealthy families rate “Legacy Development” as a top financial need.

86%

of families say it is important to leave “Life Lessons and Values” as an important part of an inheritance.

90%

say, “Our plan does not deal with our goals, wants, and objectives!”

Few families have a plan for a genuine transfer of leadership. Just getting more money to the next generation does not solve this problem. The goal is to transfer values and purpose, not just assets; ultimately creating a balance of Independence

AND Interdependence.

Few families have a plan for a genuine transfer of leadership. Just getting more money to the next generation does not solve this problem. The goal is to transfer values and purpose, not just assets; ultimately creating a balance of Independence

AND Interdependence.

1. Is the family ready to handle what is to come?

3. Are families benefiting from family philanthropy and family entrepreneurship?

2. Do the parents know where, when, and how to begin the process?

4. Why shouldn't parents be the messenger?

Most families fail at answering these types of questions – or even asking

them in the first place! We teach families how to deal with small decisions like “the mouse in the corner,” so they can take that process and use it to deal with big questions like “the elephant in the room”

Having Family Meetings is not optional!

To succeed, you must have them! Organized and Prioritized! The outcome is continuity of the family’s total wealth, both tangible and intangible.

Most families fail at answering these types of questions – or even asking

them in the first place! We teach families how to deal with small decisions like “the mouse in the corner,” so they can take that process and use it to deal with big questions like “the elephant in the room”

Having Family Meetings is not optional!

To succeed, you must have them!

Organized and Prioritized! The outcome is continuity of the family’s total wealth, both tangible and intangible.

W H Y US

Our Process

Heres how we can help you.

Fee:

For each Family Meeting – Negotiated fee based on scope of agenda (Plus Expenses)

For Work between Family Meetings – Hourly rate