Services for Wealth Advisors

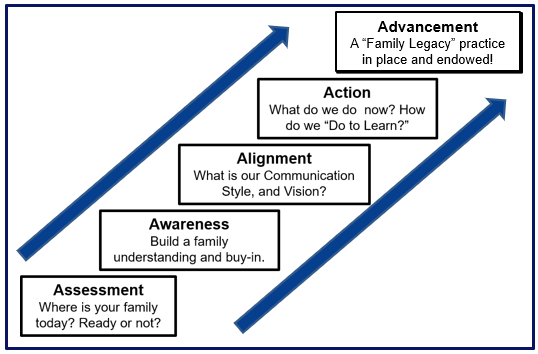

The "Family Meeting"

Can we add Family Legacy Services to your offering?

Can we add Family Legacy Services to your offering?

“W.I.S.E. Sales Training“

“W.I.S.E. Sales Training“

What the People Say

91%

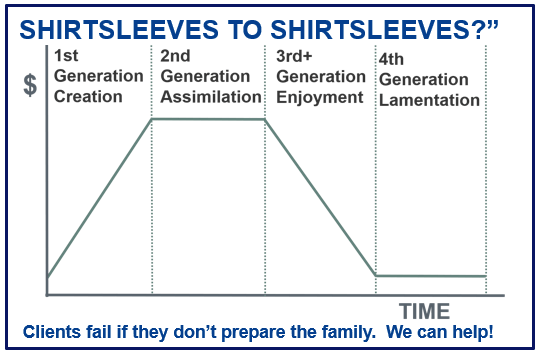

of all wealth transfers fail before getting past the grandchildren.

61%

of wealthy families rate “Legacy Development” as a top financial need.

86%

of families say it is important to leave “Life Lessons and Values” as an important part of an inheritance.

90%

say, “Our plan does not deal with our goals, wants, and objectives!”

Few families have a plan for a genuine transfer of leadership. Just getting more money to the next generation does not solve this problem. The goal is to transfer values and purpose, not just assets; ultimately creating a balance of Independence

AND Interdependence.

Few families have a plan for a genuine transfer of leadership. Just getting more money to the next generation does not solve this problem. The goal is to transfer values and purpose, not just assets; ultimately creating a balance of Independence

AND Interdependence.

1. Is the family ready to handle what is to come?

3. Are families benefiting from family philanthropy and family entrepreneurship?

2. Do the parents know where, when, and how to begin the process?

4. Why shouldn't parents be the messenger?